Someday you will either want to start spending and enjoying your TSP balance or you will be forced to start spending and enjoying a portion of your account to satisfy IRS minimum distribution rules.

One option is to stay put. TSP is low cost and trustworthy. No doubt the stock indexes do well in bull markets and the “G” fund does pay more interest than a bank savings account. However, as you get closer to retirement and your balance grows into six figures, a 100% allocation into stocks becomes too risky and a 100% allocation into the “G” fund does not keep pace with price increases in items like food and medical care.

Obviously, some serious time and attention needs to be spent maintaining the proper percentage in the various allocation options. If that is not daunting enough, choosing exactly how to receive income is subject to strict rules. The monthly income you chose can only be changed once per year during the fall open enrollment. Should an opportunity arise where you might want to take an additional partial withdrawal, fine…but if another opportunity or an emergency comes up a few years down the road, you would have to close your account to access funds.

Another option is to annuitize. This option entails trading your balance in for monthly income for life. The lifetime income sounds good. Giving up all access to your balance is not so good. TSP offers this option, but please understand you will not have access to your balance nor will you have the benefit of any inflation beating growth on that balance.

The remaining and quite popular option is to remove all or a portion of the balance and reposition it in an outside IRA. This is a tax free transfer and it can only be done once. It does not matter if you are still working or retired as long as you are over the age of 59.5 or separated from service. Finding the right IRA account could fix all the shortcomings of TSP.

Initiating a transfer and opening an IRA is simple. In fact, here are the TSP transfer forms:

TSP-75 – this form is used for a partial transfer if you are still working and over age 59.5.

TSP-70 – used after separation of service for a full transfer thereby closing the account.

TSP-77 – used after separation for a partial transfer while leaving the account open.

Deciding what type of investment your IRA should be and which financial institution to trust takes a bit more research. There are so many options, so lets simplify. We would likely take a pass on banking institutions because of low interest rates. Stock brokerage firms and mutual funds are not doing much to mitigate risk and the fee structure is likely much higher than what TSP has been charging. That leaves the insurance industry and their deferred annuities still on the table to discuss.

These financial instruments, specifically Fixed Indexed Annuities are mentioned on the tele-seminar and the blog. They are indeed worthy of study for the right person with the right kind of money. What I mean is, they are not for everybody. Annuities are not for young people and they are not a good place for money you want 100% access to in the short term.

They might be a perfect fit for someone closing in on retirement that doesn’t want to lose money in the market, yet understands they still need to grow their money faster than annual cost of living increases. They are also for people that want to take monthly or periodic withdrawals over a period years. These people tend to be fee adverse and may be concerned about outliving their savings.

To put it simply, upon reaching age 59.5 many federal employees would be wise to explore these plans. I’ll send specific detail based on individual circumstances and state of residence, but here are some general details common to most plans:

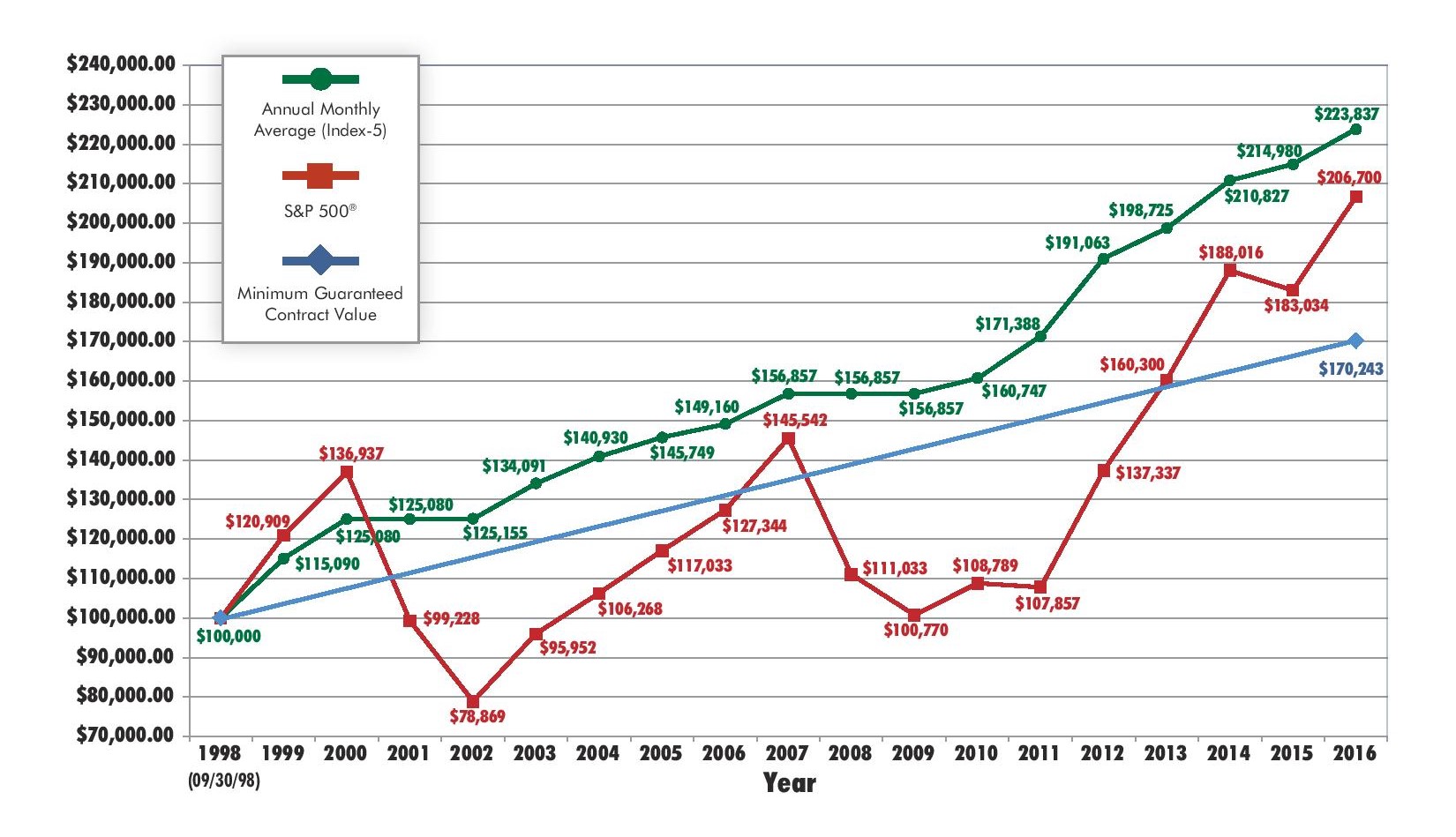

First and foremost, they all have the ability to earn interest credits based on upward stock market gains without ever giving back past gains or principal. Here is a historical example to illustrate my point:

Notice that the green indexed annuity line looks a bit like a staircase, always either stepping up to a higher level or remaining level as if on a landing. Whereas the red S&P500 line, essentially the “C” fund, looks like a roller coaster ride. Pure stock market investments have explosive upside potential and would be expected to outpace indexed annuities in a market rocketing upwards. However, we all know the markets tend to dramatically reverse course from time to time and these meltdowns can take the better part of a decade to recover from. Slow and steady really can win the race.

Here are a few articles that further discuss Fixed Indexed Annuities or FIAs:

FIAs Shine a Light… – this article touches on last years 47 billion in sales attesting to the growing popularity. Outlines the power of never going backwards, outlines how you can add lifetime income.

FIAs and In Service Withdrawals – this article explains how the last 3-5 years before retiring may be the optimum time to use an “in-service” withdrawal to get out of harms way before retiring.

Third Generation Annuities… – this article establishes a little bit of history and concludes with a warning about how bad it is to get hit with a loss at retirement time.

Five Answers about FIAs – this article examines some fundamental questions concerning fees, restrictions and earnings potential and wraps up with an interesting point about income riders.

The Power of Fixed Indexed Strategies – this article reminds us of the fundamental rules of investing and how the two most innovative features of FIAs guarantees that you will abide by those rules.

Now you have learned there are more to these plans than meets the eye. You might also see why there is some confusion as to the merits of these plans. A negative comment shared about annuitization or variable annuities tends to broad brush all annuities with no clarification that indexed annuities are a completely different instrument.

My summary and these articles are just the basics. The next step would be to schedule a follow up appointment with one of us to determine if these plans are indeed a good fit for your personal situation. If so, we’ll recommend a plan or two that might best fit your circumstances and walk you through the specific details including the pros and cons of adding the optional guaranteed lifetime income provisions.